The

MOC finalized the anti-dumping and anti-subsidy duties on imported DDGS from

the US. CCM believes, that this move will further reduce Chinese DDGS import

volume, strengthen demand for corn and soybean meal, and stimulate the supply

of alcohol.

On

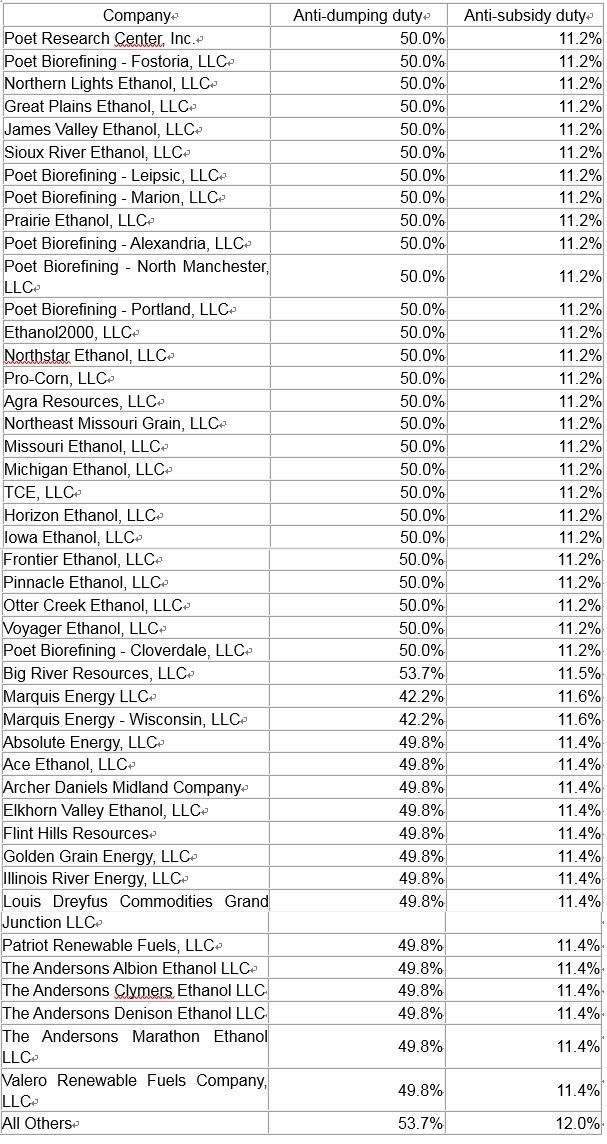

11th Jan., 2017, the Ministry of Commerce of the People's Republic of China

(MOC) announced that the US was ruled to have dumped DDGS into China, which has

caused substantial damage to the Chinese DDGS industry. Therefore, China

decided to respectively impose 42.2%-53.7% and 11.2%-12.0% of anti-dumping and

anti-subsidy duties on US DDGS for 5 years, starting 12 Jan., 2017.

Source: Baidu

In

2016, China launched anti-dumping and anti-subsidy investigations into American

DDGS:

-12th

Jan. - The MOC announced that it had decided to conduct an anti-dumping

investigation into American DDGS

-23th

Sept. - The MOC made an initial ruling that the US has dumped and subsidized

its DDGS into China. It subsequently required importers to pay an anti-dumping

deposit and an anti-subsidy deposit at 33.8% and 10.0%-10.8% respectively.

Note: Deposit amount = (duty-paid value assessed by the customs * deposit rate)

* (1 + import-related value-added tax rate)

-2nd

Aug. - The MOC held a hearing on whether to launch an anti-dumping and

anti-subsidy investigation on DDGS, at which the US and China debated whether

the US dumps DDGS into China

Actually,

in early Dec. 2010, China had launched anti-dumping and anti-subsidy

investigations into American DDGS. However, the investigations were terminated

due to various factors. At that time, China didn't form a definite conclusion

on whether the US dumps DDGS into China.

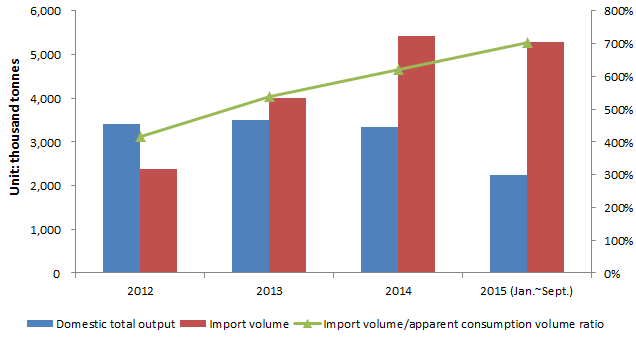

As

the largest DDGS importer in the world, China mainly imported DDGS from the US.

Compared to the DDGS made-in-China, American DDGS enjoys both a lower

price and higher quality. Coupled with the surging domestic corn price in the

past few years, import volume of DDGS rose significantly. According to China

Customs, import volume reached 6.82 million tonnes in 2015, up 26.1% YoY. In

addition, the proportion of apparent consumption volume of imported DDGS

climbed 70.2% in Jan.-Sept. 2015 from 41.6% in 2012, according to the MOC.

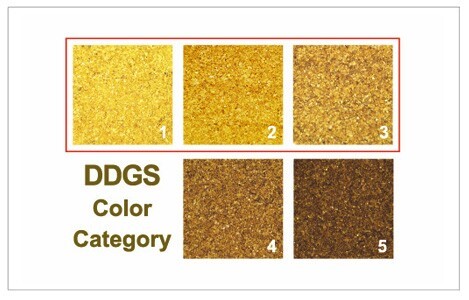

DDGS

is a by-product of corn alcohol, which can be used as a raw material in feed to

provide energy and protein. Therefore, DDGS is a good substitute for corn and

soybean meal. In 2016, China's corn price slumped and dragged down the domestic

DDGS price, resulting in sharply falling import volume of DDGS. According to

China Customs, the country imported about 3 million tonnes of DDGS in Jan.-Nov.

2016, down 46.8% YoY.

Output,

import volume and apparent consumption volume of DDGS in China, 2012-2015

(Jan.-Sept.)

Source: MOC

It

is noteworthy that China made an initial ruling on American DDGS in Sept. 2016,

caused many importers have slowed down their imports. Some feed enterprises

said that they’re now targeting domestic DDGS suppliers or homemade soybean

meal for raw materials. It is predicted that the final judgment would further

suppress DDGS import volume. CCM thinks that this may help domestic industries

in a number of ways:

1.

Increase corn consumption and reduce corn inventory

At

present, China holds a huge corn inventory – 230 million tonnes. Additionally,

the cancelation in 2016 of the purchase policy of corn for temporary storage affected

corn sales seriously in some producing areas, such as Heilongjiang Province.

2.

Raise domestic soybean meal prices

The

largely reduced DDGS import volume will strengthen demand for soybean meal. The

domestic soybean meal price will keep rising.

3.

Increase supplies of alcohol

The

strengthened demand for domestic DDGS will stimulate domestic production. The

supply of alcohol will further increase in the future.

China's

anti-dumping and anti-subsidy duties on American DDGS companies, Jan. 2017

Source:

MOC

About CCM

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the Corn market in China? Try our Newsletters

and Industrial Reports or join our professional online platform today and get

insights in Reports, Newsletter, and Market Data at one place.

For

more trade information of corn, including Import and Export analysis as well as

Manufacturer to Buyer Tracking, contact our experts in trade analysis to get

your answers today.